I.

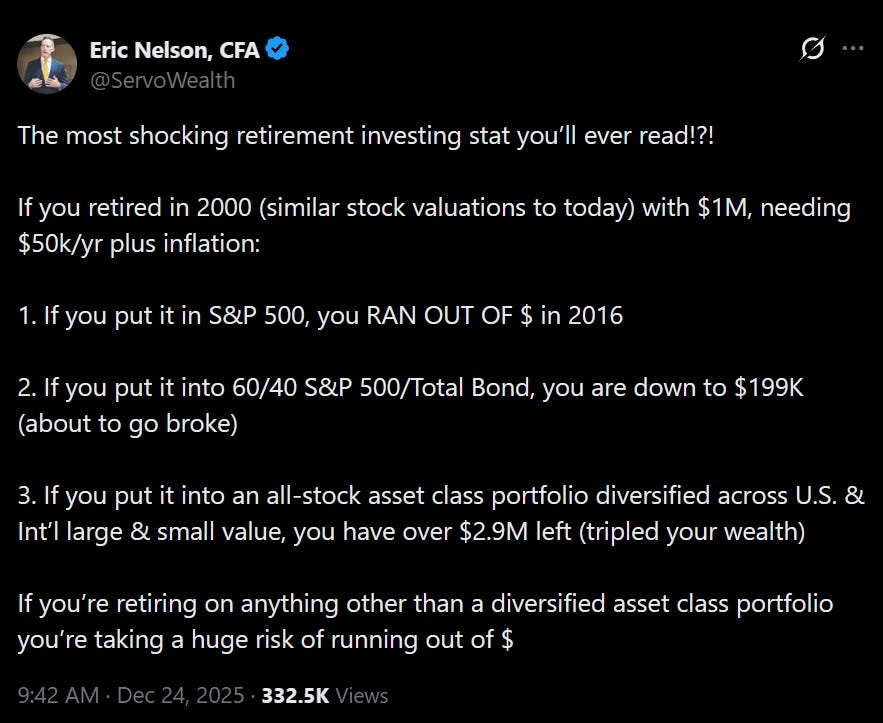

Eric Nelson presents what he calls the most shocking retirement stat ever.

His point is that just like in circa 2000 the S&P 500 is very, very expensive today. That implies a very, very likely low return over the next decade or so. And bonds wouldn’t have saved you—the hypothetical withdrawal path of $50,000/year that he describes (5% of the initial portfolio) is depletive despite the seemingly conservative start and allocation.

Stock diversity was one’s only hope.

II.

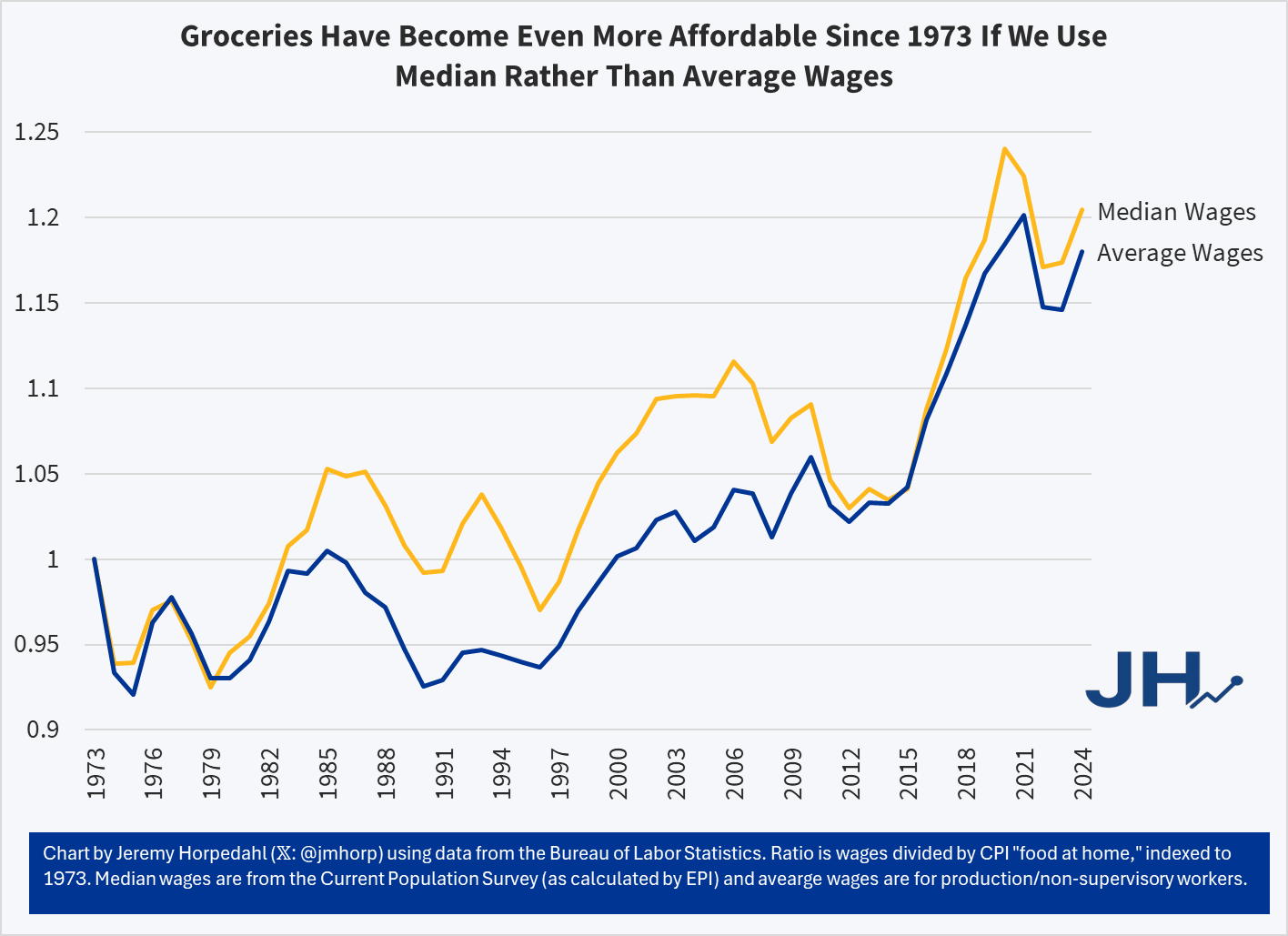

Yet maybe there is another. The cost of living continues to decline in important areas like food. In fact as Jeremy Horpedahl demonstrates, “groceries in November 2025 are the most affordable they have ever been.”

Tying the two posts together, the key to not running out of money might be work longer so as to enjoy greater wage growth and then invest wiser so as to avoid backdoor concentration risk. Of course, one could also adjust spending down, but no one does that.

III.

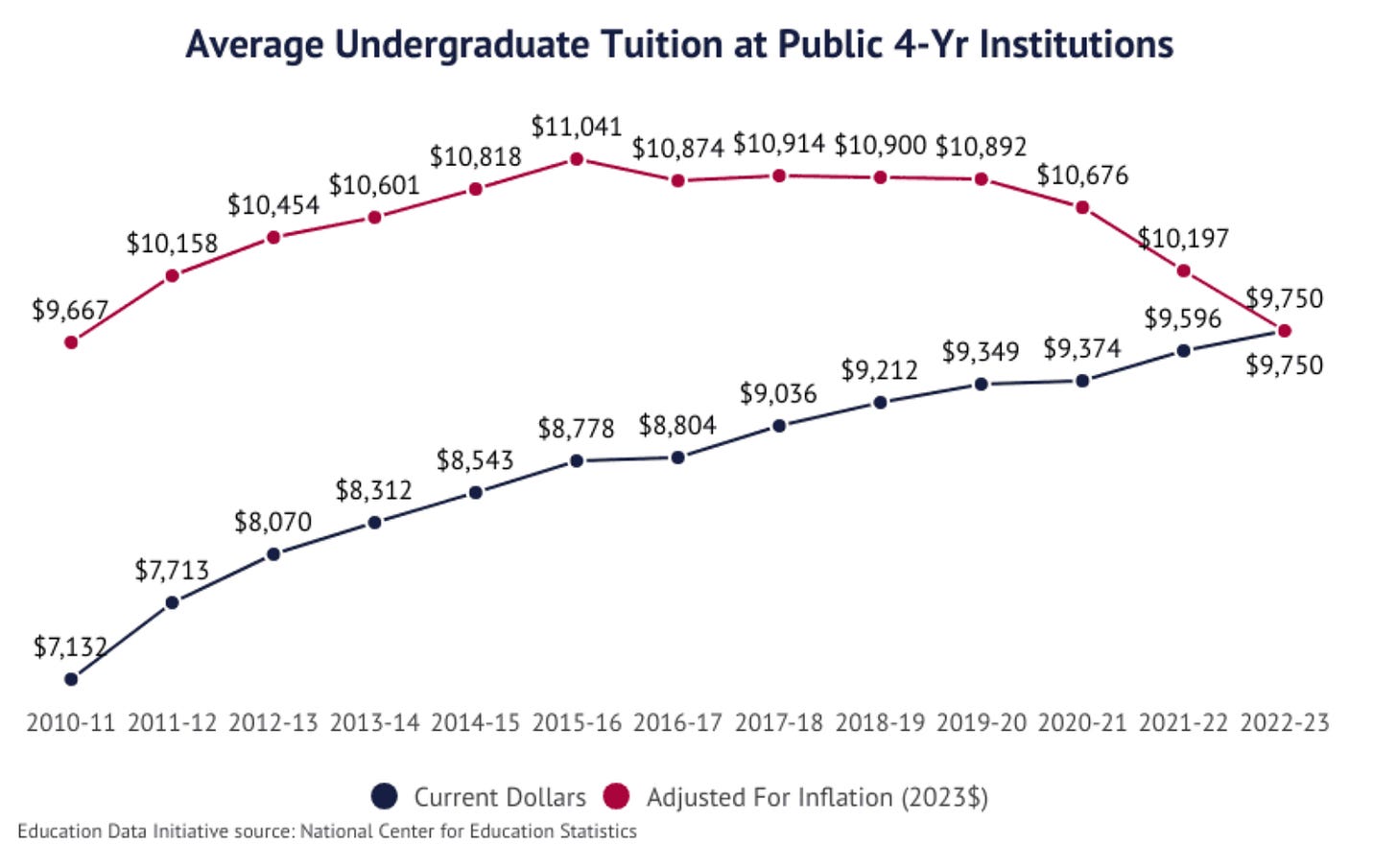

Sticking with affordability since it seems to be the theme uniting both sides of the political force, Matthew Yglesias digs into the money illusion aspects including how a shallow understanding underlies much of the public’s frustration with high prices.

Just as in Jeremy (adjusted-for-inflation) Horpedahl’s post above, once you adjust for inflation things look very different. For example in the Yglesias post we see that the real (inflation adjusted) cost (tuition and fees) of college education at public institutions has been steadily declining for over a decade. It is down 11.7% since 2015-16.

Affordability is a nuanced topic. There are a lot of variables to consider. Be careful what assumptions you bring to your projections and update often. You can’t afford not to.