Surprising Stats (What Goes Up . . . Edition)

Did you know . . . ?

Three surprising stats links for you today. The first is good news that might actually be bad news and the next two are “this-is-fine” news that is actually unsustainable bad news.

I.

We are less deviant than ever in recent memory. So argues Adam Mastroianni in The Decline of Deviance.

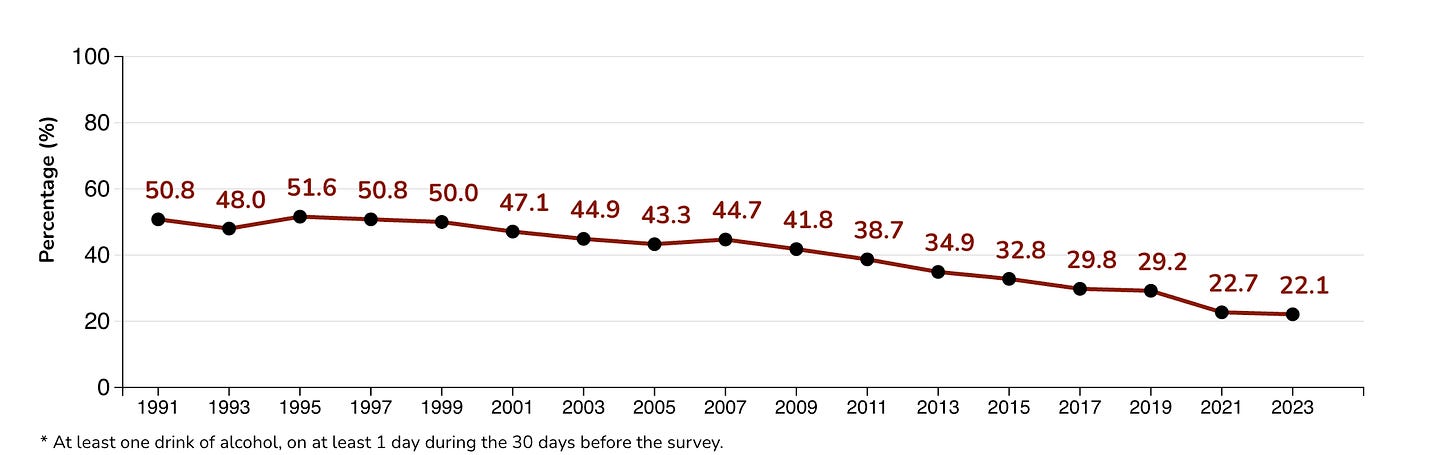

Let’s start where the data is clear, comprehensive, and overlooked: compared to their parents and grandparents, teens today are a bunch of goody-two-shoes. For instance, high school students are less than half as likely to drink alcohol as they were in the 1990s:

They’re also less likely to smoke, have sex, or get in a fight, less likely to abuse painkillers, and less likely to do meth, ecstasy, hallucinogens, inhalants, and heroin. (Don’t kids vape now instead of smoking? No: vaping also declined from 2015 to 2023.) Weed peaked in the late 90s, when almost 50% of high schoolers reported that they had toked up at least once. Now that number is down to 30%. Kids these days are even more likely to use their seatbelts.

They’re even less likely to bring a gun to school.

I didn’t find a lot of these otherwise very interesting statistics to be that surprising, but perhaps you will. The story is we’ve gotten very homogenized and boring. The world is safer and less innovative it would seem. The reasons behind it and the implications as described in the post are themselves somewhat interesting and surprising.

This post from Mastroianni is certainly counter-conventional wisdom. It isn’t as long as it appears as there are a lot of great graphs and other pictorial evidence presented. Definitely worth the read and consideration of his thesis. The story about sculptor Arturo di Modica and his famous work, the Charging Bull, might make my 52 things learned for the year post.

II.

Consistent with the desire for increased safety, we have only a short leap to the current state and future status of Social Security.

According to the latest Social Security Trustees Report, closing the system’s funding gap would require raising the payroll tax to 16%, costing the median worker earning $67,000 about $110,000 more over their lifetime—the equivalent of working two full years for free. [emphasis added]

That is from Romina Boccia at The Debt Dispatch. The kids might not be taking risks, but their grandparents happen to be doing it for them financially. Well, at least they’ll have AI to help them through the coming mess, right . . .

III.

Well, maybe not.

Recently, analysts at JPMorgan Fundamental Research created a financial model that projects total investment in global AI infrastructure through 2030, taking physical limitations into account. That figure is $5 trillion.

Then they calculated how much new revenue these companies will have to generate to justify that $5 trillion investment in AI supercomputers. The result: AI products would have to create an additional $650 billion a year, indefinitely, to give investors a reasonable 10% annual return. That’s more than 150% of Apple’s yearly revenue, and a far cry from OpenAI’s current revenue of about $20 billion a year.

This equates to every iPhone owner in the world paying an extra $35 or so a month for products and subscriptions, according to the JPMorgan analysts.

That is from Christopher Mims and Nate Rattner in the Wall Street Journal.

The implication is not that AI won’t be revolutionary and a great boon to mankind. I certainly believe it will be. I just think that the benefits will flow to the consumer rather than the companies pouring TRILLIONS into it. The bad news is for the investors who are committing vast amounts of capital to investments that almost certainly will disappoint—even if they are profitable. Rate of return matters A LOT.

Risk is a tricky, harsh mistress.