Is the Market Pricing in TACO?

Corruption is Less Bad Than Faith-Based Dogma

Initially my subtitle to this post, “Corruption is Less Bad Than Faith-Based Dogma”, was going to be the title, but I thought that was too clunky. Still, I struggle to find a way to properly introduce my thinking here. Perhaps this is because it is very hard to get a handle on what is going on.

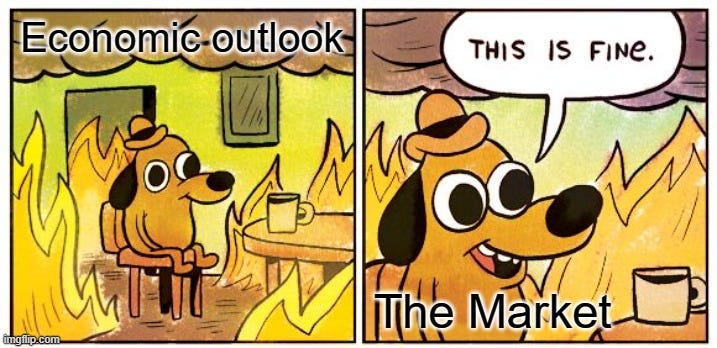

Specifically, why are the capital markets seemingly so sanguine while, to at least some of us, there is so much trouble brewing?

I’m going to end up sounding a lot like Paul Krugman in this post, and I’m not entirely comfortable about that. Not just because I don’t want to write/think like him—he is at his worst when he lets emotions overtake his rational, great economist mind.1 It is also because I don’t think his diagnosis is very good. Markets might not seem to price in existential risk (still room for debate here), but that isn’t the current situation anyway. It’s bad, man, but it ain’t that bad.

Regardless, this vibe isn’t total off base:

The gist of the puzzle is this: The market reacted quite strongly to several policies of the Trump administration as they first developed. Tariffs are the most stark, but there were others as well. On top of that we have ample reason to believe many things we are witnessing are not great, Bob!

Mostly this is true in a policy sense, but there are other general economic developments that indicate weakness. Of course, that might all just be what a soft landing looks like. Hard to know since the U.S. economy has never had one, but there is room to believe this time it has. Still, the policy developments are unequivocally bad.

One big example is the on-going effort to shrink our labor force by reversing immigration. This includes the cruel, haphazard round up of people with all the unlawful features (e.g., no due process) and the “accidental” grabbing of U.S. citizens in the process. Additionally, many of those swept up in this process entered the US legally and have committed no crimes while here. Do whatever you want to try and justify this morally or legally, yet two facts remain:

The U.S. desperately needs immigrants to help our aging and shrinking domestic workforce as well as provide some help to our social programs that are nearing insolvency.2

No economy has ever grown long term with a shrinking labor supply.

So all the things we see going on look quite concerning. Whether we watch Fox News or MSNBC, we see pretty much the same thing with just different interpretive packaging. However, seeing past the self-serving presentation in these media portrayals gives us a great microcosm for the bigger point I’m going to make in this post.

The extremely harsh intolerance for immigration is happening.3

The effect is a reversal of immigrant arrival trends as well as self deportation.

And yet still . . . Trump isn’t anywhere close to being on track to achieving his promise to deport all illegal immigrants.

Whether because of the physical impossibility of the task or the growing opposition to it, Trump is not achieving an immigrant-free United States. As beautiful/ugly as it is to us observing, it is just a big show. Please don’t take this as downplaying the impact. Many, many people are caught up in this circus with their lives being upturned drastically. All I am saying is Trump is once again playing to his naive base and (fortunately) stopping short of what he claims he is pursuing.

Notice that this isn’t TACO (Trump Always Chickens Out). That was a much better fit for tariffs, which is where this term of art emerged among investors. And even then (see below), I don’t think that is fully what is going on even there.

This is Trump Isn’t Actually Doing It (TIADI?), but that doesn’t make a catchy acronym. Still, he is doing something, and that must be reconciled for its impact.

I know this is difficult for many to fathom, but what if he isn’t Chairman Trump, Great Philosopher King as the NFT imagery claims him to be. What if he is just a simple con man? Many (supporters and opponents alike) would argue that he has to be more than that given the stature and accomplishments. So what if he is just a simple mob boss who has risen to power and is just getting while the getting is good? What if Trump isn’t an ideologically-driven mastermind, but simply is corrupt?

Hence, I want to suggest we aren’t in a TACO-based market. We are in a market grounded in TISC (Trump Is Simply Corrupt, pronounced “tisk” to help make this acronym stick).

Still not as catchy, but I think it is more fitting.

Look at the evidence:

Meme coins he and his family have personally benefited from financially and the same meme coins have been explicitly used to buy influence with Trump

Golf course and skyscraper in Vietnam coupled by no coincidence with a better tariff deal

The 747 from Qatar

The shakedown/extortion of higher ed (yes, they needed some comeuppance, and they needed to be reigned in for many bad policies, but good ends don't justify the means and bad ends certainly don't justify the means)

. . . Sadly, this is not an exhaustive list.

Say what you will about prior administrations' lack of transparency, this one is showing you the crime saving you the time discovering it.

Examining him deeper we find a failed businessman with a serious inferiority complex who desperately wants to be an elite. He has no idea why he would not be liked much less loved and has no idea what it takes to actually win and succeed—he mistakes the appearance of the end result for the means. He really took to heart the (non-replicable, pseudoscience conclusion) “fake it ‘til you make it” bit. In this sense he is the leader of a cargo cult—his followers don’t seem to know the difference between actually succeeding and looking successful.

He has no morally-guided gumption or ethical regard allowing him to tolerate any wrongdoing that benefits him in the least. This is the heart of his motivations. His technique is master bullshitter. His drive is aggrandizement.

Consider this very partial list of how this “conservative” leader is having the U.S. government interact with the private sector:

U.S. government take an ownership share in US Steel and Intel as well as other AI/tech companies

Either directly demanding or indirectly implying the need for general tributes from corporate leaders using company funds

Heavy-handed interventions into the labor market

Tariff taxes distorting outcomes including the large detriment of small U.S. companies

These are all his way of “succeeding” in business—a quest he never could approach legitimately throughout his career. He doesn't create value. He takes it like a mob boss.

All of this is terrible in its own right, but its implications for the broader economy are limited. At the very least those impacts are much, much less damaging than if all his threats and supposed policy views came to fruition.

This is how the market can price his policies so benignly. This is how the market’s reactions to on-going policy developments (including the daily flip flop) can be so seemingly neutral if not positive for (some) equities.

The big and powerful (S&P 500 and mega-caps especially) stand to benefit at least relatively in an environment that rewards the powerful, entrenched incumbents. Small caps are much more subject to tariff woes and much less able to buy influence and protection.

The bond market on the other hand must grapple with the risks that higher and higher debt poses. Afterall, Trump is leading us to new found highs (lows) in terms of government deficit spending. And here the market response is fairly appropriate.

Perhaps this helps explain high valuation premiums (stock prices that reflect paying a lot for current earnings) as well as relatively high interest rates that persist.

Rightfully, some would challenge that high stock valuations require high earnings growth, which is predicated upon a strong, growing economy. Many market participants are perhaps themselves engaged in a bit of faith-based reasoning hoping that the good in Trump’s economic policies will outweigh the bad. I’m thinking in regard to the extent that these policies benefit large U.S. companies. For this (admittedly) just-so story to be true it would have to mean that these companies benefit in an absolute sense. Relative benefit isn’t enough—losing less is still losing meaning large-cap stocks couldn’t command such absolutely high premiums that exist today.

In other words, the stock prices for large U.S. companies are VERY high today compared to any historical comparison or theoretical model. They can only be rationally priced this way if the future is VERY bright for them. And rationality has to be the starting point in our thinking. Markets are very efficient generally, and this is especially true of markets pricing large U.S. companies. To claim simply that this time is different is a very, very big claim requiring a lot of work on those making it.

From the bond market’s perspective there isn’t as much of a mystery since either a forecast of general economic growth or higher debt concerns would tend to push and keep interest rates up higher.

Somewhat alternatively if not at the same time, economically bad policies might not hold. When I first was drafting this post, I predicted what came to be this past Friday thinking: Perhaps the market is wisely pricing in that Trump will lose his appeal of the court’s decision against his ability to do all the tariff taxes that he has attempted to impose.

I was going to support it with this case in point where Cantor Fitzgerald was attempting to purchase the rights to tariff refunds from those companies who have had the taxes imposed upon them. I’m not sure if they got their deal, but if they did, last Friday was a good day for them.

Partially this would have been/was the market predicting that calamity will be avoided. Additionally, this would also be the market realizing that corruption is not nearly as costly as a moronic religious-like zeal to institute mercantilist policies that we’ve known were stupid for centuries.

In this story the market is relieved because corruption is cheaper than crazy. A thief can be bought off. An insane fanatic cannot.

Of course there could be other things going on. It is a big world after all. AI could be being priced in as an epic economic game changer. Perhaps DOGE will be a deregulatory miracle worker—although, it is hard to see how that only benefits mega firms if it even relatively benefits them at all. Remember how regulatory capture works—the biggest firms capture the regulator getting them to impose costs (regulation and other) on their potential rivals. But who knows?

And maybe I’m wrong on a more fundamental level. Perhaps tariffs are neutral to good and everyone else is slowly waking up to this after the initial (hypothetically incorrect) reactions. Perhaps stopping if not reversing immigrant flows is an economic boon. Perhaps I’ve even got it all wrong and there is not even any corruption going on. Or maybe graft and aggrandizement is beneficial to the economy from which that activity is flowing.

So take all of this with a grain of salt. It is just a story to try to reconcile what we see around us grounded in what has been settled economic science.

For those in the Trump cult (and I use that advisedly with the points made in this post explicitly supporting it), this will be a head scratcher because they were told (lied to) repeatedly that it turns out immigrants were inappropriately getting welfare of all kinds including Social Security to the extent that they were a big part of the problem if not all of it. First tapping into the conspiracy-theory vulnerability of so many people and then maximizing it to the point of weaponization has got to be the biggest accomplishment of the rightwing. It has been a masterclass in achieving power by unlocking and coordinating this latent opportunity.

Trump supporters defend this as appropriate and desirable. Opponents feel the opposite, but regardless no one really denies that is the new policy stance.